Why More Credit Unions Are Adopting eMortgage Tech Than Ever Before

Credit unions are rapidly adopting eMortgage technology to streamline lending, reduce paperwork, and deliver faster, more convenient member experiences. With digital closings, eNotes, and improved compliance, they’re boosting efficiency and staying competitive in today’s digital-first mortgage landscape.

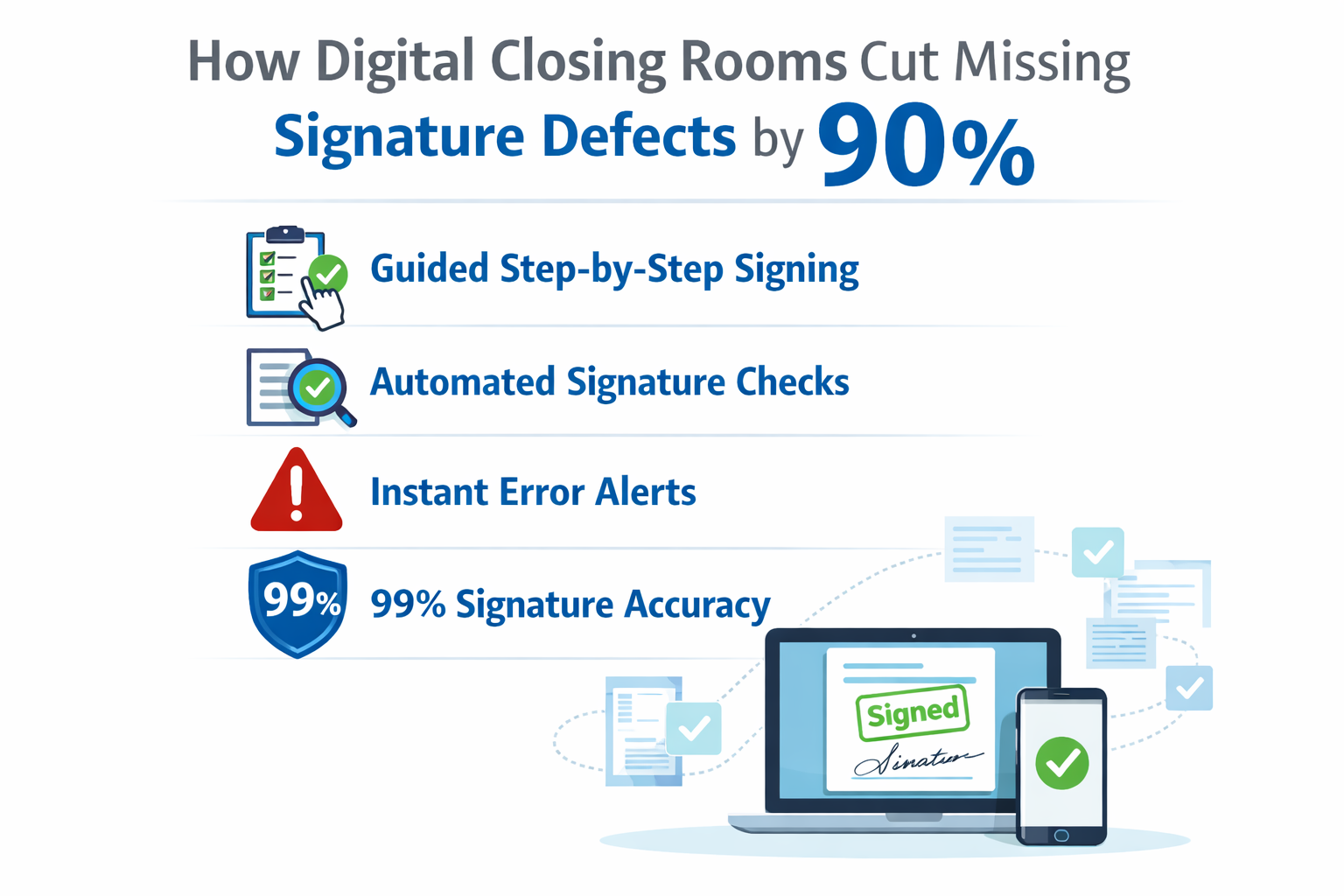

How Digital Closing Rooms Are Cutting Missing Signature Defects by 90%

Digital closing rooms reduce missing signature defects by up to 90% with automation, real-time validation, and smarter workflows that ensure error-free closings.

Why Warehouse Lenders Are Pushing for Full eVault Interoperability in 2026

As the mortgage industry moves deeper into the digital era, warehouse lenders find themselves at the center of a rapidly shifting ecosystem, one in which interoperability is no longer simply a goal but a fundamental requirement for long-term success.

Cutting Closing Times in Half with eSign and Remote Online Notarization

Explore how electronic signatures and Remote Online Notarization speed up closings, boost accuracy, and modernize the mortgage experience.

The Rise of Mobile-First Mortgage Experiences

In 2026, the mortgage industry is undergoing one of its biggest usability shifts ever: borrowers now expect a mobile-first mortgage experience from application to closing. What began as a convenience trend has become the new standard as digital-native consumers, accelerated timelines, and competitive lending markets reshape how lenders design their engagement strategies.

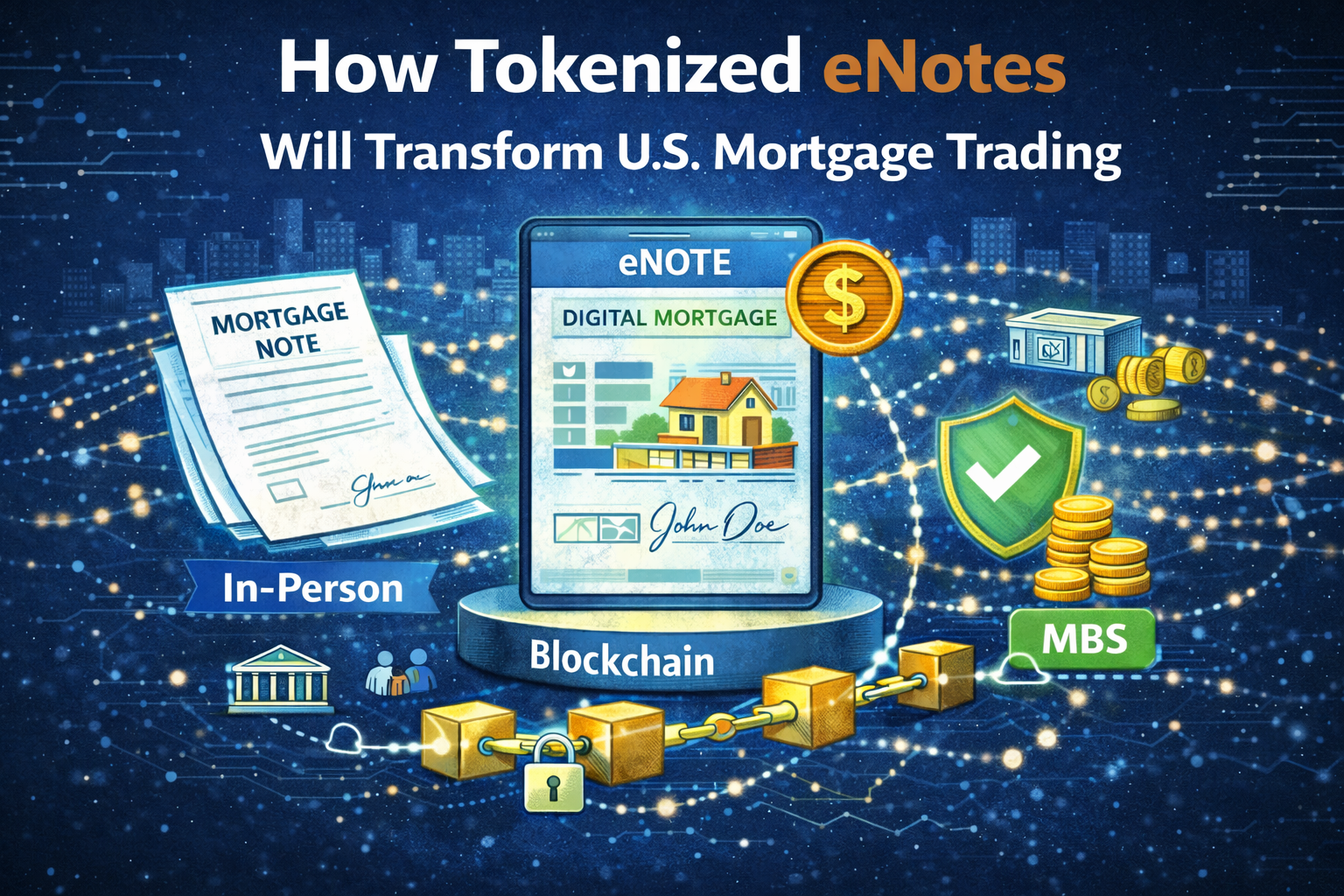

How Tokenized eNotes Will Transform U.S. Mortgage Trading

Tokenization is rapidly reshaping financial markets, and the mortgage industry is next in line. As digital mortgage adoption accelerates in the United States, a new frontier is emerging: tokenized eNotes—digitally native promissory notes converted into blockchain-secured, instantly tradable assets.

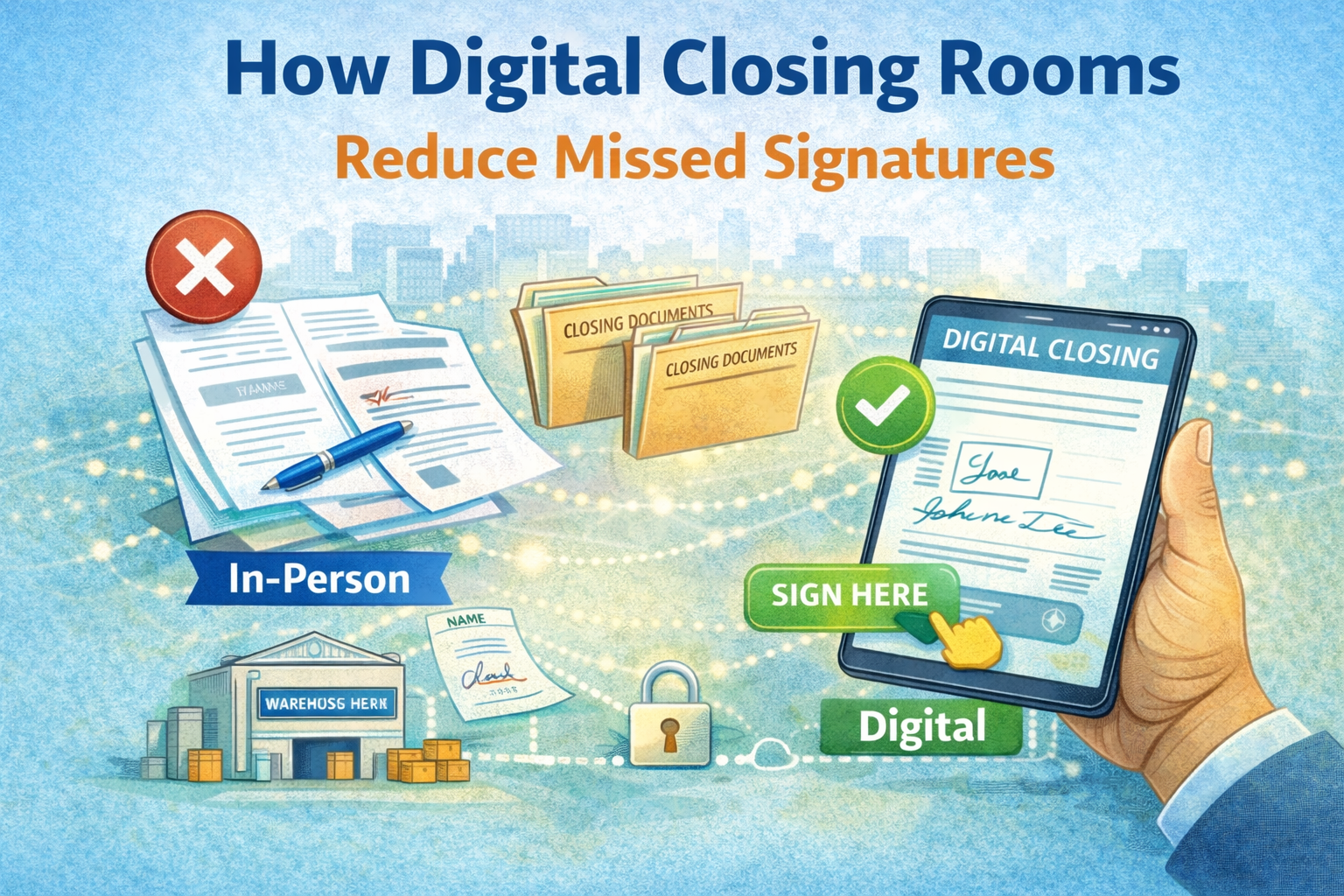

How Digital Closing Rooms Reduce Missed Signatures

Missed signatures are one of the most persistent and costly defects in mortgage closings. Even a single overlooked initial or date can delay funding, trigger post-closing repairs, or even put warehouse lines at risk. Traditional paper closings make it easy for borrowers, settlement agents, and even loan officers to miss required signatures buried within thick document packages.

Why Investors Pay a Premium for Digital-Ready Loans

In 2026, the secondary mortgage market is increasingly shaped by digital efficiency, data integrity, and rapid capital movement. As a result, investors are now willing to pay noticeably higher premiums for digital-ready loans—loans manufactured, closed, stored, and delivered through modern digital workflows.

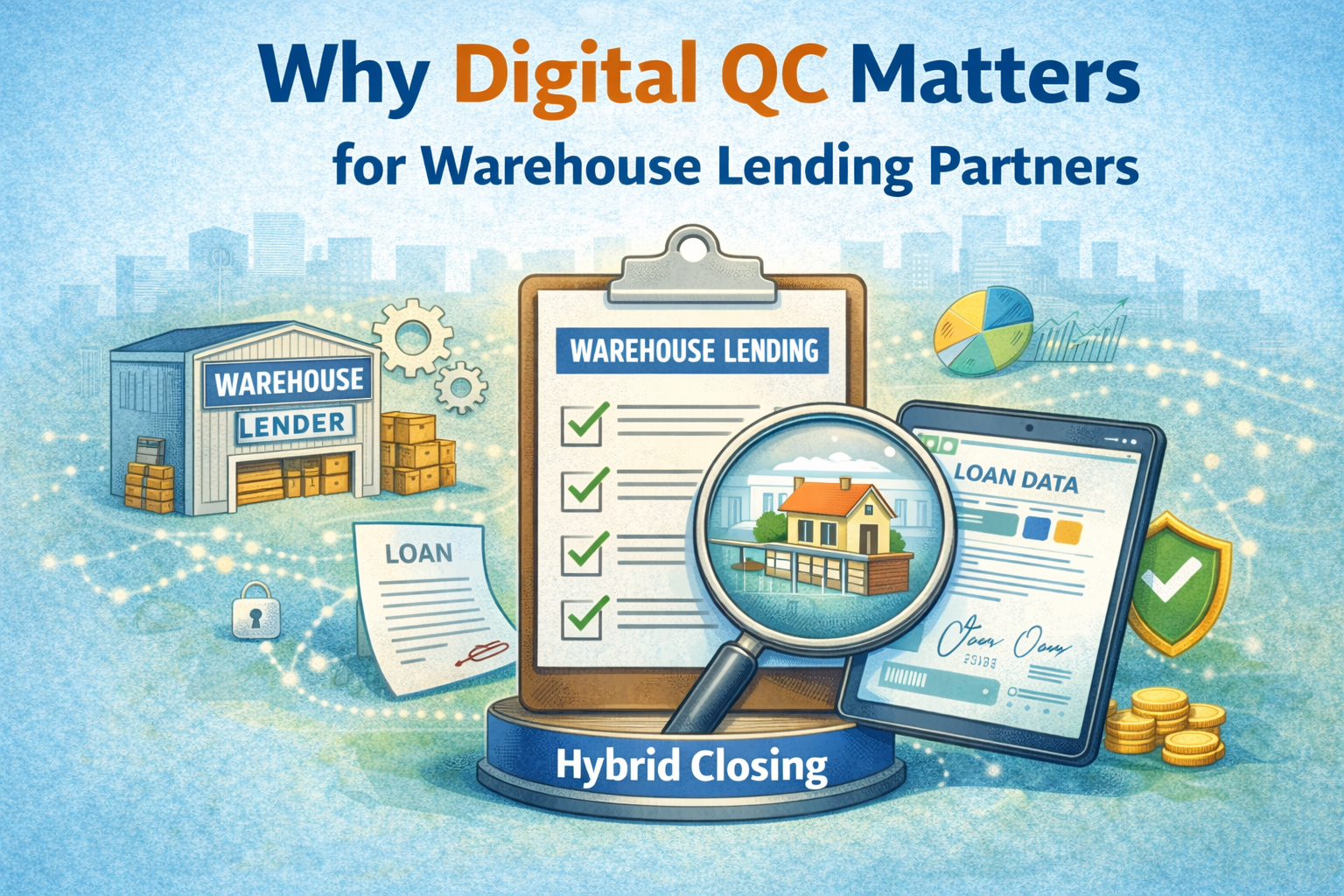

Why Digital QC Matters for Warehouse Lending Partners

Warehouse lenders play a critical role in mortgage origination, providing short-term liquidity so lenders can fund loans before they are sold on the secondary market. But with rising regulatory scrutiny, shrinking margins, and growing loan-level risk, warehouse partners are more selective than ever about which lenders they choose to work with.

How eClosings Improve Loan Officer Productivity

Loan officers today face increasing pressure to produce more volume with fewer resources, tighter margins, and higher borrower expectations. The traditional mortgage closing process — heavy on paperwork, coordination, and manual reviews — often slows them down.

The Rise of Hybrid Closings & Why Lenders Prefer Them

The mortgage industry has undergone a dramatic digital shift over the past decade, and 2026 marks a turning point in how lenders close loans. While full eClosings continue to grow, the fastest-rising model today is the hybrid closing — a blend of digital signing and traditional wet-sign components.

The Economic Impact of eVault Interoperability in 2026

In the digital age, data security and efficient document management are foundational to enterprise operations, especially in regulated industries such as finance, healthcare, and legal services. As electronic storage solutions have replaced physical archives, the importance of secure digital vaults — known as eVaults — has grown.

How eMortgage Technology Improves Pull-Through Rates

In today’s highly competitive lending environment, improving pull-through rates is one of the most effective ways for lenders to increase revenue without increasing lead volume.

Remote Notarization and Borrower Trust in the Digital Era

Learn how RON builds borrower trust with secure identity checks, verified signing sessions, and tamper-proof closing documents.

How Digital Collateral Reduces Secondary Market Costs

Learn how digital collateral lowers secondary market costs by reducing defects, eliminating shipping, accelerating custodial reviews, and improving investor confidence. Discover why digital eNotes lead to faster sales, lower warehouse interest, and more efficient capital markets execution.

Cost Savings from Switching to Full eClosing

Discover how Full eClosing dramatically reduces mortgage origination costs by eliminating paper, cutting QC defects, accelerating warehouse line turns, and improving investor delivery. Learn how lenders save $300–$700+ per loan with fully digital closings.

The Coming Wave of Federal Digital Mortgage Oversight

Discover how federal agencies are increasing oversight of digital mortgages, from eNotes to eVaults. Learn what new regulations mean for lenders, compliance, and the future of digital mortgage workflows.

eNote Defect Reduction: What Makes Digital Signatures More Secure?

Digital signatures dramatically reduce eNote defects by enhancing identity verification, tamper detection, audit trails, and data security—helping lenders improve loan quality, compliance, and secondary market readiness.

The Difference Between Paper and Digital Custody Chains

Explore the key differences between paper and digital custody chains, and learn how eNotes and eVaults improve security, speed, compliance, and efficiency across the modern mortgage ecosystem.

Mortgage Fraud Reduction Through Digital Tamper Seals

Discover how digital tamper seals prevent mortgage fraud by securing document integrity, detecting alterations instantly, and ensuring trusted, tamper-proof eNotes throughout the lending and secondary market process.